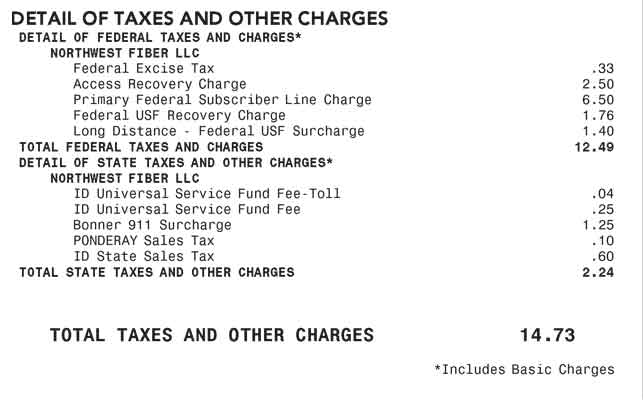

Ziply Fiber is committed to providing refreshingly great customer experience. We believe in transparency and offering simple, straightforward pricing. As part of this commitment, we’ve outlined the details of taxes and surcharges included in your Ziply Fiber bill that are listed on page 4 of your bill.

Taxes and surcharges differ by state and services provided. Some are mandated by state, local and/or federal requirements (and may vary) while others may come from Ziply Fiber. Taxes are assessed on the full price of the service, not a discounted or promotional rate.

Here is an alphabetical list of the taxes and other charges you may see on your bill.

Additional State Taxes—Each state may levy additional state taxes; often similar to those levied at federal level.

City Tax—Collected for City Governments, tax may cover telecommunication services equipment, installation, maintenance, local and long distance service.

Emergency Service Fee for 911—State-law mandated fee covers costs of local jurisdictions providing 911 emergency response services to citizens. Fee is (a) amount per telephone access line or (b) percentage of revenue. Ziply Fiber collects and pays to 911 jurisdictions.

Federal Carrier Cost Recovery Charge—Recovers national costs associated with various federal regulatory fees and programs. Rates vary from company to company, as do names for this charge.

Federal Excise Tax—Local telephone service and facilities tax. It is a percentage of cost of services, seen on local phone portion of bill. Ziply Fiber collects and pays directly to IRS.

Federal Subscriber Line Charge—Nationwide FCC-regulated charge to recover portion of costs associated with providing long distance carriers with access to local phone network. Long distance carriers pay remainder of cost.

Federal Universal Service Fund (USF) Charge—FCC-regulated charge supports telecommunications services in schools, public libraries, rural health-care facilities. Subsidizes local service to high-cost areas and low-income customers. Monthly, per-line surcharge helps keep local telephone rates affordable.

Gross Revenue Surcharge—Telephone companies must pay tax on total revenue. This funds Public Utility Commissions and other state services. Represents each consumer's portion of that tax on revenue.

Internet Infrastructure surcharge (Ziply Fiber Removing on 4/1/2021)—This monthly surcharge is to help cover some of the costs of maintenance of the local network. This fee is not a tax or fee required by the government.

Intrastate Access Charge—State-assessed charge partially reimburses telephone service providers for costs associated with routing their customers' long distance calls. Applied to all phone customers whether they make long distance calls or not.

Local Programming Fee—This monthly feel helps cover the cost Ziply Fiber pays local channel networks to deliver local channels, news and other local programming to each territory. The fee applies to all video tiers.

Native American State and Local Sales Tax—Native Americans may qualify for a state and local sales tax exemption. If you are a Tribal member residing on Tribal land, you may apply for the Sales Tax exemption. Please complete this form and email to [email protected].

Regional Sports Fee—This monthly fee helps cover the cost Ziply Fiber pays to Regional Sports Networks to deliver professional and collegiate sports programming in each local team’s territory. The fee applies to video tiers that include regional sports.

Sales Tax—Local, state or other sales tax may be applied to your telecommunications charges, as it is for many other types of purchases.

Service Provider Number Portability—Federal law requires all local phone companies to provide "service provider number portability" so customers may keep phone number when switching local phone service provider. Helps recover costs associated with development, implementation, and operability of service.

Telecommunication Relay Service / Hearing Impaired / Telecommunications Device for Deaf—Provides special-needs equipment, facilities and services for the deaf. This includes special phones, hearing devices, Braille pads, network switching equipment, and specialized service center customers. It is state-specific and established by state law, public utility commission rule or tariff filings.

Video—A combination of FCC regulatory charges, broadcast TV surcharges, and local franchise fees may be applied to your video/TV services. See the individual video fees listed under "Details of Taxes and Other Charges", usually on page 4 of your bill.

VoIP Administrative Fee (Ziply Fiber Removing on 4/1/2021)—Ziply Fiber imposes an administrative fee to recover some of the government and other fees that we incur for VoIP service.